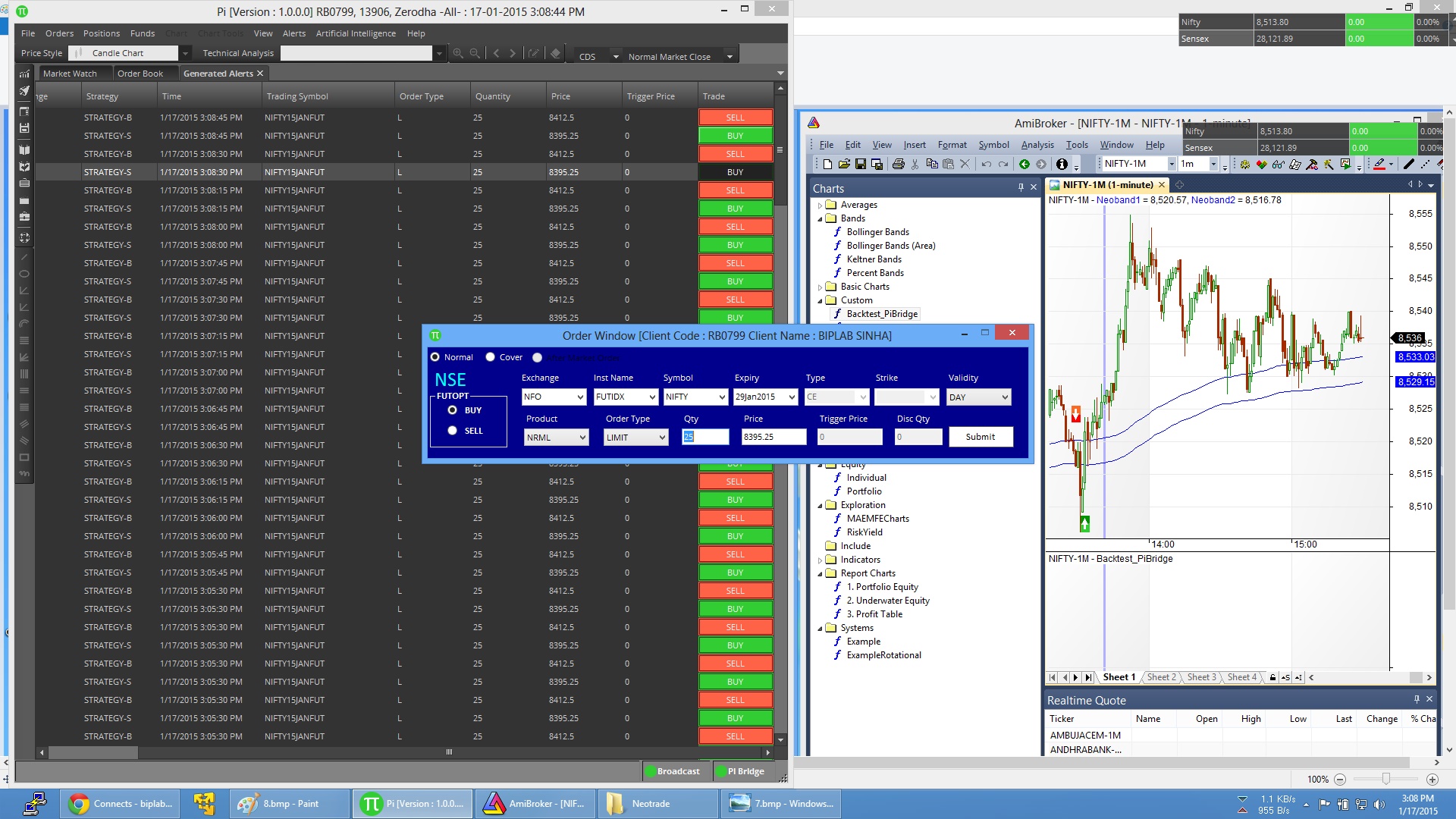

Then you have to enter UPI ID to complete the payment. Click on IPO & select the desired IPO from the list. You will get the IPO option in the ‘Portfolio Menu’. You can buy IPOs using Zerodha’s Console. The 3-in-1 account allows you hassle-free fund transfer from the bank account to the trading account. Once you have an IDFC First bank account you can call 080 4913 2020, the team will help you open a 3-in-1 account. You need an IDFC First bank account to open a 3-in-1 Zerodha account that includes bank account, Demat & trading account. Zerodha Demat & Trading Account Additional Features #1. You have to pay DP charges when you sell the shares from your demat account.Įarlier, there were charges on the redemption of mutual funds also, which are no longer charged since May 3, 2019. 100.ĭepository Participant (DP) charges on equity stock are Rs. Other ChargesĪccount opening charges for Trading & Demat account is Rs. 75 every three months from the date of account opening. Zerodha’s Annual Maintenance Charge is Rs. Intraday trading includes equity, currency, and commodity trading. That means, if you are investing in stocks for long-term, you won’t have to pay any brokerage.įor intraday, trading charges are Flat Rs.

Zerodha charges ZERO fee on the stock delivery. 10,00,000 in 20 trades, you will have to pay Rs. 10,00,000 every month, you will have to pay charges as below:īrokerage charges: 0.55% (Includes both buying & selling) If you do 10 trades (20 trades including buying & selling) of Rs. Let me show you the comparison of both scenarios Flat Fee vs. You can save a good amount on brokerage with a flat fee per order. 20 per order, which is very low compared to the traditional brokers. If you are a day trader you have to pay a minimum of Rs. Zerodha Review: founded in 2010, Zerodha was the first broking firm that introduced the flat brokerage fee per order in India, which can help you save up to 90% on your brokerage charges.

0 kommentar(er)

0 kommentar(er)